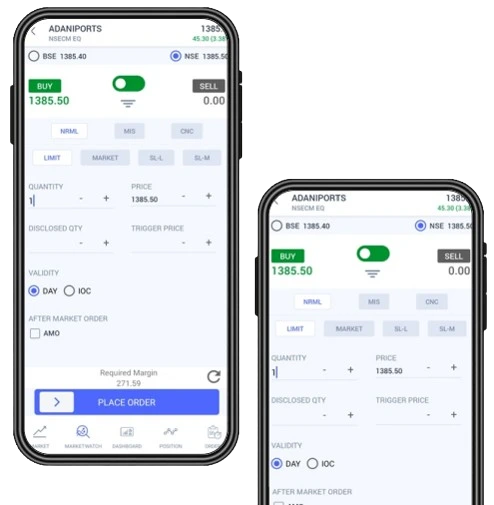

Invest in

Stocks & Indices

Invest in Stocks via SIP. Get Instant Margin for Intraday Trading!

Start NowEverything You Need to Invest in Mutual Funds

No Fees Forever!

Invest in direct mutual funds in India at Zero cost - for lifetime!

Discover Top Funds

Discover and invest in top rated and consistent performing mutual funds

Rich Portfolio Insights

Get Smart Insights on your invested Mutual Funds for free!

Manage SIPs like a Pro

Setup AutoPay or invest instantly with 1-Tap Top-up whenever you want

Trade And Invest In Most Popular Stocks

Reliance Industries

2939.90

76.70 (2.68%)

Infosys

1533.60

61.35 (4.17%)

Larsen & Toubro

3532.50

49.95 (1.43%)

JSW Steel

912.15

24.05 (2.71%)

Asian Paints

2927.70

22.90 (0.79%)

Bharat Petroleum

599.80

15.65 (2.68%)

Hindustan Unilever

2577.80

28.20 (1.11%)

Hindalco Industries

680.35

2.85 (0.42%)

Trade & Invest in Stocks from Your Favorite Sector

Finance Stocks

Bank Stocks

IT Stocks

FMCG Stocks

Auto Stocks

Power Stocks

Pharma Stocks

Health Stocks

Attention

Investors: